Welcome to the future of banking with Fino Payment Bank Login! In today’s fast-paced world, where time is of the essence and convenience is paramount, traditional banking methods often fall short of meeting the evolving needs of customers. However, with Fino Payment Bank, a new era of banking convenience has dawned.

- Overview of Fino Payment Bank Login

- Step-by-Step Guide Login Process of Fino Payment Bank Login

- Troubleshooting Common Issues Fino Payment Bank Login

- The Benefits of Fino Payment Bank Login

- Security Measures in Place of Fino Payment Bank Login

- Personalized Banking Solutions of Fino Payment Bank Login

- Customer Support and Assistance of Fino Payment Bank Login

- Empowering Financial Inclusion of Fino Payment Bank Login

- Accessing Transaction History Through Fino Payment Bank Login

- Frequently Asked Question (FAQs)

Overview of Fino Payment Bank Login

| Aspect | Details |

|---|---|

| Name | Fino Payment Bank |

| Type | Digital-first bank |

| Services | Banking, financial inclusion, digital payments, loans, insurance, savings accounts, investment options |

| Access | Website, mobile app (available on App Store and Google Play Store) |

| Key Features | Seamless transactions, personalized banking solutions, 24/7 customer support, financial inclusion |

| Security Measures | Robust encryption protocols, multi-factor authentication, secure transactions |

| Customer Base | Millions of users across India |

| Vision | Empowering financial inclusion and reaching the unbanked population |

| Website | https://partner.finopaymentbank.in/ |

| Headquarters | Mumbai, India |

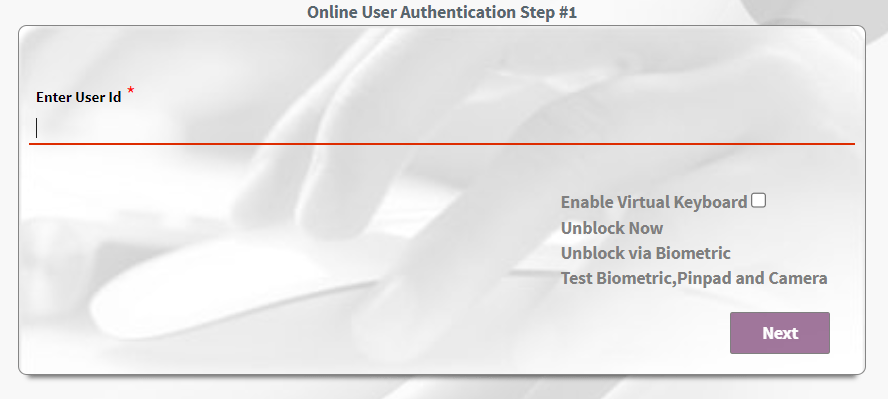

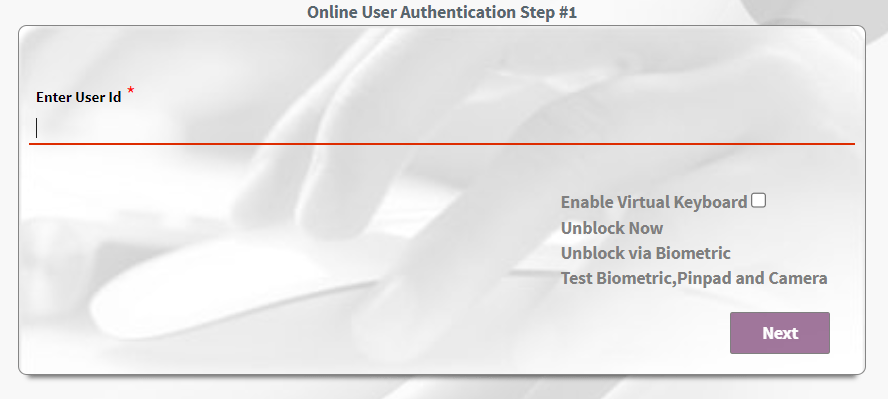

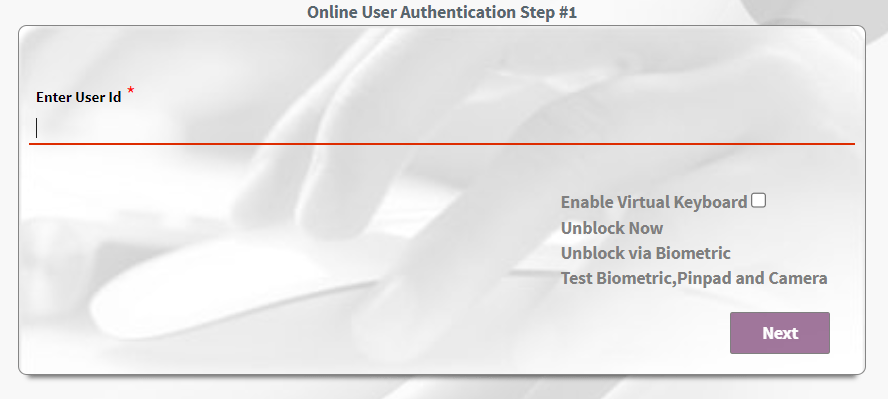

Step-by-Step Guide Login Process of Fino Payment Bank Login

| Step | Description |

|---|---|

| 1 | Open the Fino Payment Bank mobile app or website |

| 2 | Click on the “Login” or “Sign In” button |

| 3 | Enter your registered mobile number or email ID |

| 4 | Input your unique password |

| 5 | Optionally, authenticate using biometrics (if enabled) |

| 6 | Click on the “Login” button |

| 7 | Wait for the system to verify your credentials |

| 8 | Upon successful verification, you’ll be directed to your account dashboard |

| 9 | Access various banking services such as account balance check, fund transfer, bill payment, etc. |

| 10 | Logout securely after completing your transactions |

Troubleshooting Common Issues Fino Payment Bank Login

| Common Issue | Troubleshooting Steps |

|---|---|

| Forgot Password | 1. Click on the “Forgot Password” link on the login page. 2. Follow the instructions to reset your password. |

| Incorrect Credentials | 1. Double-check your entered mobile number/email and password. 2. Ensure caps lock is off. 3. Reset your password if necessary. |

| Biometric Authentication Failure | 1. Ensure your device supports biometric authentication and it’s enabled. 2. Try re-registering your biometrics in the settings. |

| Account Locked | 1. Contact Fino Payment Bank customer support for assistance. 2. Verify your identity to unlock your account. |

| Network Issues | 1. Check your internet connection. 2. Switch to a different network or try again later. 3. Restart your device. |

| App/Website Errors | 1. Clear cache and cookies from your browser or app settings. 2. Update the app to the latest version. 3. Reinstall the app if necessary. |

| Security Warnings | 1. Ensure you’re logging in through the official Fino Payment Bank website or app. 2. Avoid clicking on suspicious links or sharing OTPs/passwords. |

The Benefits of Fino Payment Bank Login

Convenience: Access your financial institution account every time, anywhere with only a few clicks.

24/7 Access: Enjoy round-the-clock get entry to on your account statistics and banking services.

Secure Transactions: Conduct transactions with peace of thoughts, way to strong encryption and safety features.

Ease of Use: User-pleasant interface makes banking simple and hassle-free for customers of all ages.

Personalized Banking: Customize your banking experience with tailor-made services and answers to suit your needs.

Quick Fund Transfer: Transfer price range hastily to friends, family, or groups the usage of the Fino Payment Bank platform.

Bill Payments: Pay utility bills, cell recharges, and other bills readily from your account.

Instant Alerts: Stay informed approximately account activities and transactions thru real-time notifications.

Financial Management: Keep track of your prices, control budgets, and screen account balances effortlessly.

Support and Assistance: Access committed customer service for any queries or assistance with banking offerings.

Security Measures in Place of Fino Payment Bank Login

Robust Encryption: Utilizes advanced encryption protocols to shield consumer facts at some stage in transmission and garage.

Multi-factor Authentication: Implements a couple of layers of authentication, including OTPs and biometric verification, to ensure handiest authorized users get admission to debts.

Secure Password Policies: Enforces strong password requirements, which includes a combination of alphanumeric characters and special symbols, to enhance account safety.

Device Recognition: Utilizes tool recognition technology to become aware of and authenticate relied on devices, minimizing the risk of unauthorized get right of entry to.

Session Timeout: Automatically logs out inactive customers after a special duration of state of being inactive to save you unauthorized get right of entry to to accounts.

Fraud Monitoring: Implements state-of-the-art fraud detection structures to reveal account sports and pick out suspicious transactions in real-time.

Regular Security Audits: Conducts regular safety audits and checks to become aware of and address capability vulnerabilities in the machine.

Customer Education: Provides educational sources and tips to clients on a way to safeguard their accounts and recognize phishing attempts or fraudulent sports.

Secure Communication: Ensures steady communique channels between clients’ devices and the Fino Payment Bank servers to defend touchy information.

Compliance with Regulatory Standards: Adheres to stringent regulatory standards and tips to hold the highest stages of protection and compliance with enterprise guidelines.

Personalized Banking Solutions of Fino Payment Bank Login

24/7 Availability: Access customer service services spherical-the-clock, making sure help is to be had each time wished.

Multiple Channels: Reach out for help through diverse channels such as smartphone, email, stay chat, or in-person at financial institution branches.

Dedicated Helpline: Benefit from a committed helpline range for quick assistance with login-associated queries or problems.

Knowledgeable Representatives: Interact with informed customer service representatives educated to address a wide range of concerns efficaciously.

Prompt Response: Receive set off responses to queries, making sure minimal wait times and efficient resolution of issues.

FAQs and Knowledge Base: Access a comprehensive FAQ section and understanding base on the website or app to discover solutions to commonly requested questions.

Troubleshooting Guidance: Receive step-by-step guidance for troubleshooting commonplace login-associated issues thru self-carrier alternatives or help from aid agents.

Personalized Assistance: Receive personalised help tailored to individual needs, ensuring a fantastic and quality patron revel in.

Feedback Mechanism: Provide feedback at the first-class of aid obtained to help improve provider requirements usually.

Commitment to Customer Satisfaction: Experience a commitment to purchaser satisfaction, with support offerings aimed at resolving problems efficiently and enhancing average consumer experience.

Customer Support and Assistance of Fino Payment Bank Login

Accessibility: Provides banking services to far flung and underserved areas, achieving populations traditionally excluded from the formal banking region.

Low-Cost Services: Offers low priced banking solutions, along with primary savings accounts and microloans, making economic offerings available to low-income people.

Agent Network: Utilizes a good sized community of banking retailers to facilitate coins deposits, withdrawals, and different transactions in rural and concrete regions wherein financial institution branches are scarce.

Digital Solutions: Leverages technology to offer virtual banking offerings handy thru smartphones, enabling even the ones without access to standard banking infrastructure to control their finances with ease.

Financial Literacy Programs: Conducts instructional initiatives and workshops to promote economic literacy and empower individuals with the know-how and competencies to make knowledgeable financial decisions.

Microfinance Initiatives: Provides microfinance offerings to small groups and entrepreneurs, fostering economic growth and development in underserved groups.

Government Schemes: Facilitates the distribution of presidency subsidies, welfare bills, and social blessings to beneficiaries through its banking platform, ensuring well timed and transparent delivery of funds.

Partnerships: Collaborates with authorities agencies, NGOs, and different groups to extend monetary services to marginalized businesses and sell inclusive increase.

Customized Products: Develops tailor-made monetary services and products to deal with the unique desires and demanding situations faced by using underserved populations, which includes bendy reimbursement alternatives and small-price ticket loans.

Empowering Financial Inclusion of Fino Payment Bank Login

Accessibility: Provides banking services to far flung and underserved areas, achieving populations traditionally excluded from the formal banking region.

Low-Cost Services: Offers low priced banking solutions, along with primary savings accounts and microloans, making economic offerings available to low-income people.

Agent Network: Utilizes a good sized community of banking retailers to facilitate coins deposits, withdrawals, and different transactions in rural and concrete regions wherein financial institution branches are scarce.

Digital Solutions: Leverages technology to offer virtual banking offerings handy thru smartphones, enabling even the ones without access to standard banking infrastructure to control their finances with ease.

Financial Literacy Programs: Conducts instructional initiatives and workshops to promote economic literacy and empower individuals with the know-how and competencies to make knowledgeable financial decisions.

Microfinance Initiatives: Provides microfinance offerings to small groups and entrepreneurs, fostering economic growth and development in underserved groups.

Government Schemes: Facilitates the distribution of presidency subsidies, welfare bills, and social blessings to beneficiaries through its banking platform, ensuring well timed and transparent delivery of funds.

Partnerships: Collaborates with authorities agencies, NGOs, and different groups to extend monetary services to marginalized businesses and sell inclusive increase.

Customized Products: Develops tailor-made monetary services and products to deal with the unique desires and demanding situations faced by using underserved populations, which includes bendy reimbursement alternatives and small-price ticket loans.

Accessing Transaction History Through Fino Payment Bank Login

Visit the Fino Payment Bank Website or App: Open the Fino Payment Bank reputable net website online or cellular app in your device.

Click on the ‘Login’ Button: Locate and click on the ‘Login’ button at the homepage to get admission to your account.

Enter Login Credentials: Input your registered mobile variety or username and password. Ensure your credentials are accurate to avoid login troubles.

Complete Security Verification: If prompted, entire any safety verification steps, which encompass entering an OTP (One-Time Password) despatched to your registered mobile huge range.

Navigate to ‘Accounts’ or ‘Transaction History’: Once logged in, locate the ‘Accounts’ section or at once look for an preference labeled ‘Transaction History’ at the dashboard.

Select the Relevant Account: If you have multiple accounts, select the ideal account for that you want to view the transaction data.

View Transaction Details: The transaction history web web page will display all transactions, which includes deposits, withdrawals, and transfers, collectively with their dates and portions.

Filter and Sort Transactions: Use filtering options (like date variety, transaction type, and so forth.) to slim down your search for specific transactions.

Download or Print Transaction History: If wanted, download or print the transaction history for file-retaining via the usage of the furnished options.

Log Out Securely: After having access to your transaction history, make sure you log out of your Fino Payment Bank account to preserve your account’s safety.

Frequently Asked Questions (FAQs)

Q1. How do I register for Fino Payment Bank Login?

To sign in for Fino Payment Bank , you want to visit the nearest Fino Payment Bank department or follow online thru the legit internet site or cellular app. You may be required to provide private statistics and complete the account opening system.

Q2. What are the requirements for Fino Payment Bank Login?

The necessities for Fino Payment Bank consist of a registered cellular range or email ID and a completely unique password. Additionally, biometric authentication may be enabled for brought safety.

Q3. Is Fino Payment Bank Login stable?

Yes, Fino Payment Bank is stable. The financial institution employs strong encryption protocols, multi-thing authentication, and different security measures to shield customer records and prevent unauthorized get entry to.

Q4. What need to I do if I forget about my Fino Payment Bank Login password?

If you neglect your Fino Payment Bank password, you could click at the “Forgot Password” hyperlink on the login web page and comply with the commands to reset your password. You may also need to affirm your identity via OTP or different way.

Q5. Can I get right of entry to Fino Payment Bank Login from a couple of devices?

Yes, you can access Fino Payment Bank from a couple of gadgets consisting of smartphones, capsules, and computers. However, make certain that you log off securely after every session and avoid accessing your account from public or unsecured networks.