In this blog, we embark on a journey to explore the myriad features and benefits of Capital First Login, understanding how it revolutionizes the way individuals manage their finances. From account management to loan applications, investment opportunities to personalized financial insights, Capital First Login offers a comprehensive suite of services designed to cater to the diverse needs of its users.

- Overview of Capital First Login

- Step-by-Step Guide Login Process of Capital First Login

- Troubleshooting Common Issues Capital First Login

- Account Management Made Easy Capital First Login

- Seamless Loan Application Process Capital First Login

- Investment Opportunities at Your Fingertips Capital First Login

- Security Measures for Peace of Mind Capital First Login

- Mobile Accessibility for On-the-Go Banking Capital First Login

- Frequently Asked Question (FAQs)

Overview of Capital First Login

| Aspect | Description |

|---|---|

| Institution | Capital First is a leading financial institution offering banking and loan services. |

| Platform | Capital First Login is the online portal provided by Capital First for its customers. |

| Services | Account management, loan applications, investment opportunities, financial insights. |

| Accessibility | Accessible via web browser and mobile app, offering convenient banking on-the-go. |

| Security | Robust security measures including encryption and multi-factor authentication. |

| Support | Various support channels available for assistance with banking queries and issues. |

| Benefits | Convenience, accessibility, personalized insights, investment opportunities. |

| Goal | To simplify financial management and empower users to make informed decisions. |

| Website | http://www.capitalfirst.com/ |

Step-by-Step Guide Login Process of Capital First Login

| Step | Description |

|---|---|

| 1. Open Web Browser | Launch your preferred web browser on your computer or mobile device. |

| 2. Visit Website | Type the official website address of Capital First in the address bar: www.capitalfirst.com |

| 3. Locate Login | Once on the homepage, locate the ‘Login’ or ‘Sign In’ option at the top-right corner. |

| 4. Click on Login | Click on the ‘Login’ button to proceed to the login page. |

| 5. Enter Credentials | Enter your registered Username and Password in the respective fields. |

| 6. Verify Security | Complete any security verification steps such as entering a One-Time Password (OTP). |

| 7. Click Login | After entering the required information, click on the ‘Login’ or ‘Sign In’ button. |

| 8. Access Account | Upon successful verification, you’ll be granted access to your Capital First account. |

| 9. Navigate Dashboard | Explore the dashboard to view account balances, transaction history, and other services. |

| 10. Logout | Once you’ve completed your banking tasks, remember to log out for security purposes. |

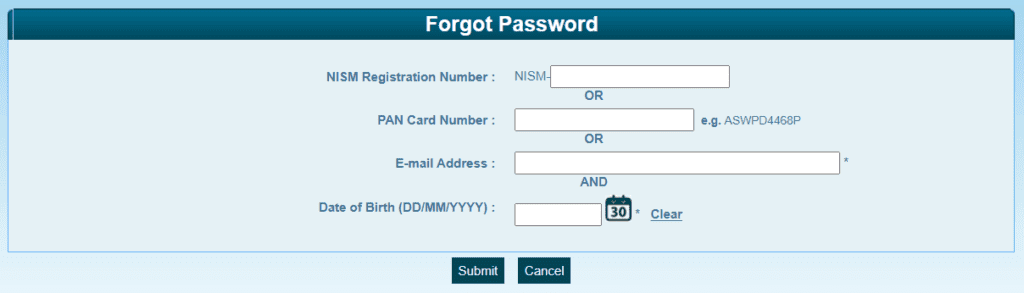

Troubleshooting Common Issues Capital First Login

| Common Issue | Troubleshooting Steps |

|---|---|

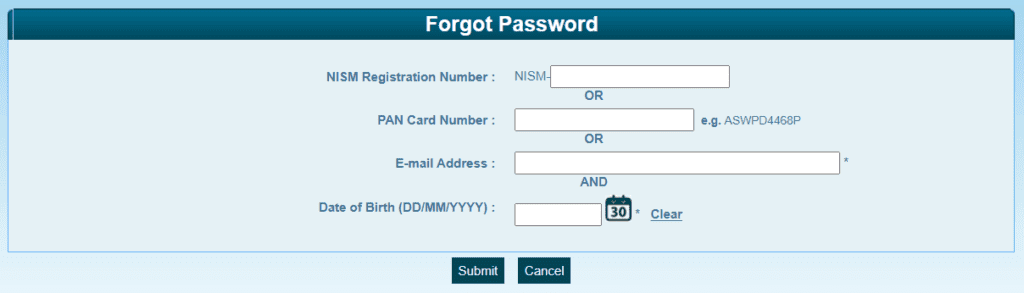

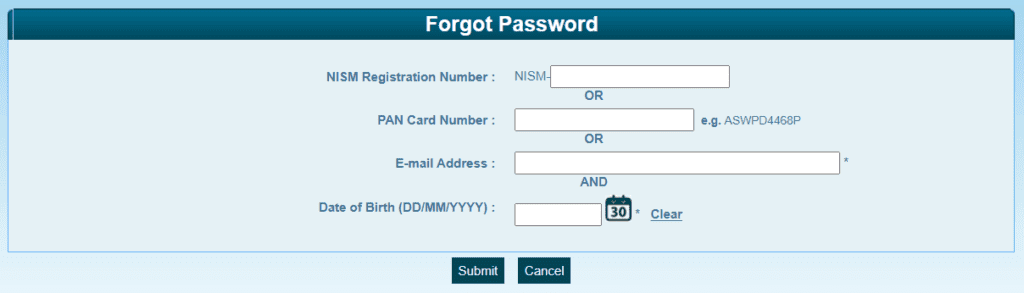

| Forgotten Password | Click on the ‘Forgot Password’ option on the login page to reset your password. |

| Incorrect Username or Password | Double-check the spelling of your username and ensure your password is entered correctly. |

| Account Locked | Contact Capital First customer support to unlock your account or follow the online account recovery process. |

| Browser Compatibility Issues | Try using a different web browser or update your current browser to the latest version. |

| Connectivity Problems | Ensure you have a stable internet connection and try logging in again. |

| Security Verification Failure | Follow the prompts to complete security verification, such as entering a One-Time Password (OTP) or answering security questions. |

| Account Registration Issues | If you’re unable to register your account, verify that you’re providing accurate information and contact customer support for assistance. |

| Mobile App Malfunctions | Update the Capital First mobile app to the latest version or reinstall it if necessary. |

| Server Downtime | Check for any announcements regarding scheduled maintenance and try again later. |

| Third-Party Interference | Disable any browser extensions or plugins that may be interfering with the login process. |

| Account Access Denied Due to Policy Changes | Review Capital First’s terms and conditions for any policy changes and contact customer support for further assistance. |

Account Management Made Easy Capital First Login

Login: Access Capital First Login the use of your registered username and password.

Dashboard Overview: Upon login, you may land for your dashboard displaying a top level view of your debts.

Account Balances: Easily view balances of your savings, current, and different money owed related with Capital First.

Transaction History: Check your transaction history to display incoming and outgoing budget.

Transfer Funds: Initiate fund transfers among your Capital First debts or to external debts seamlessly.

Bill Payments: Set up and manage bill payments for utilities, credit playing cards, loans, and extra inside some clicks.

Manage Investments: Monitor and manage your investments, including mutual budget and stuck deposits, via the platform.

Loan Management: Access details of your present loans, which includes repayment schedules and notable amounts.

Profile Updates: Keep your personal records updated by editing your profile information as wished.

Security: Capital First Login guarantees the safety of your money owed with sturdy measures like encryption and multi-component authentication.

Seamless Loan Application Process Capital First Login

Login: Access your Capital First account the use of your registered username and password.

Loan Section: Locate the “Apply for a Loan” or comparable choice inside the dashboard or navigation menu.

Choose Loan Type: Select the kind of mortgage you want to use for, including non-public loan, domestic mortgage, or car loan.

Fill Application Form: Complete the loan application shape with accurate personal and economic information.

Document Upload: Upload vital documents, which include identity, earnings evidence, and address verification.

Loan Amount and Tenure: Specify the favored mortgage amount and tenure primarily based on your necessities and repayment potential.

Review and Submit: Double-test all the facts supplied, ensuring accuracy, and then post your mortgage utility.

Application Processing: Capital First’s team will manner your utility and may attain out for additional statistics if required.

Approval and Disbursement: Upon approval, overview the mortgage phrases and conditions, and upon agreement, the loan quantity can be distributed on your particular account.

Loan Repayment: Once the loan is allotted, control your loan compensation through Capital First Login, ensuring well timed bills to hold an awesome credit rating.

Investment Opportunities at Your Fingertips Capital First Login

Login: Access your Capital First account the use of your registered username and password.

Investment Section: Locate the “Investments” or comparable choice inside the dashboard or navigation menu.

Explore Investment Products: Browse through the available investment products presented by way of Capital First, which include mutual budget, constant deposits, and other funding devices.

Research: Review specific statistics approximately each investment choice, inclusive of chance profiles, historic overall performance, and potential returns.

Select Investment: Choose the investment product that aligns together with your monetary goals, hazard tolerance, and investment horizon.

Investment Amount: Decide on the amount you desire to invest and specify it while initiating the funding method.

Payment Method: Select the preferred fee method for making an investment budget, including direct debit out of your financial institution account.

Confirmation: Review the investment information, along with the funding amount, product decided on, and price technique, before confirming the transaction.

Track Investments: Monitor the performance of your investments through Capital First Login, with get entry to to actual-time updates and statements.

Review and Adjust: Periodically overview your investment portfolio and don’t forget adjusting it primarily based on converting market conditions or your financial objectives.

Security Measures for Peace of Mind Capital First Login

Secure Login Credentials: Use a strong and precise combination of username and password on your Capital First account.

Multi-Factor Authentication (MFA): Capital First employs MFA, requiring a further verification step, such as a One-Time Password (OTP), to beautify account protection.

Encryption: All records transmitted among your tool and Capital First’s servers is encrypted, ensuring that sensitive statistics remains covered from unauthorized get entry to.

Secure Connection: Capital First’s internet site and mobile app make use of stable HTTPS connections to guard your statistics throughout transit.

Device Recognition: Capital First’s structures may additionally recognize your registered devices, adding an extra layer of safety and alerting you of any unrecognized devices trying to access your account.

Account Lockout Policy: To prevent unauthorized get admission to, Capital First may put into effect an account lockout policy after a couple of failed login tries.

Security Alerts: Receive real-time protection indicators via electronic mail or SMS for any suspicious sports detected in your account.

Regular Security Updates: Capital First continuously updates its systems and security protocols to mitigate emerging threats and vulnerabilities.

User Education: Capital First provides educational sources and recommendations to help customers decorate their cognizance of on line security satisfactory practices.

Customer Support: In case of any safety concerns or suspected unauthorized get entry to, directly contact Capital First’s customer support for help and steering.

Mobile Accessibility for On-the-Go Banking Capital First Login

Download App: Install the Capital First cell banking app from the App Store (for iOS devices) or Google Play Store (for Android devices).

Login: Open the app and log in the use of your registered username and password.

Dashboard Overview: Upon login, you will be greeted with a top level view of your accounts and latest transactions.

Account Balances: Easily take a look at your account balances for savings, modern-day, and different debts connected with Capital First.

Transfer Funds: Initiate fund transfers between your Capital First debts or to outside accounts with no trouble from your cell tool.

Bill Payments: Set up and manage invoice bills for utilities, credit score cards, loans, and greater with only a few faucets.

Mobile Deposit: Some cellular banking apps may additionally provide the functionality to deposit tests by using shooting an image using your device’s camera.

Security Features: Capital First’s cellular app employs sturdy security features, such as encryption and multi-element authentication, to make sure the safety of your transactions.

Alerts and Notifications: Receive actual-time indicators and notifications to your cell tool for account activities, safety signals, and upcoming payments.

Customer Support: Access customer support without delay from the cell app for help with any banking queries or technical troubles.

Frequently Asked Questions (FAQs)

1. What is Capital First Login?

Capital First Login is the online portal furnished with the aid of Capital First, a main monetary organization, permitting clients to get entry to various banking offerings and manage their debts remotely.

2. How do I register for Capital First Login?

To sign up for Capital First Login, you usually want to visit the reputable internet site of Capital First and comply with the registration technique, which usually involves imparting non-public and account-related information.

3. What banking offerings can I get entry to via Capital First Login?

With Capital First Login, you may perform diverse banking obligations inclusive of bank account balances, viewing transaction records, moving budget between accounts, paying bills, making use of for loans, and exploring funding opportunities.

4. Is Capital First Login stable?

Yes, Capital First takes security critically and implements strong measures to safeguard your information. This includes encryption, multi-component authentication, steady connections, and everyday safety updates.

5. Can I get right of entry to Capital First Login from my cell tool?

Yes, Capital First usually offers cellular accessibility thru its cellular banking app, allowing clients to control their finances readily from their smartphones or capsules.