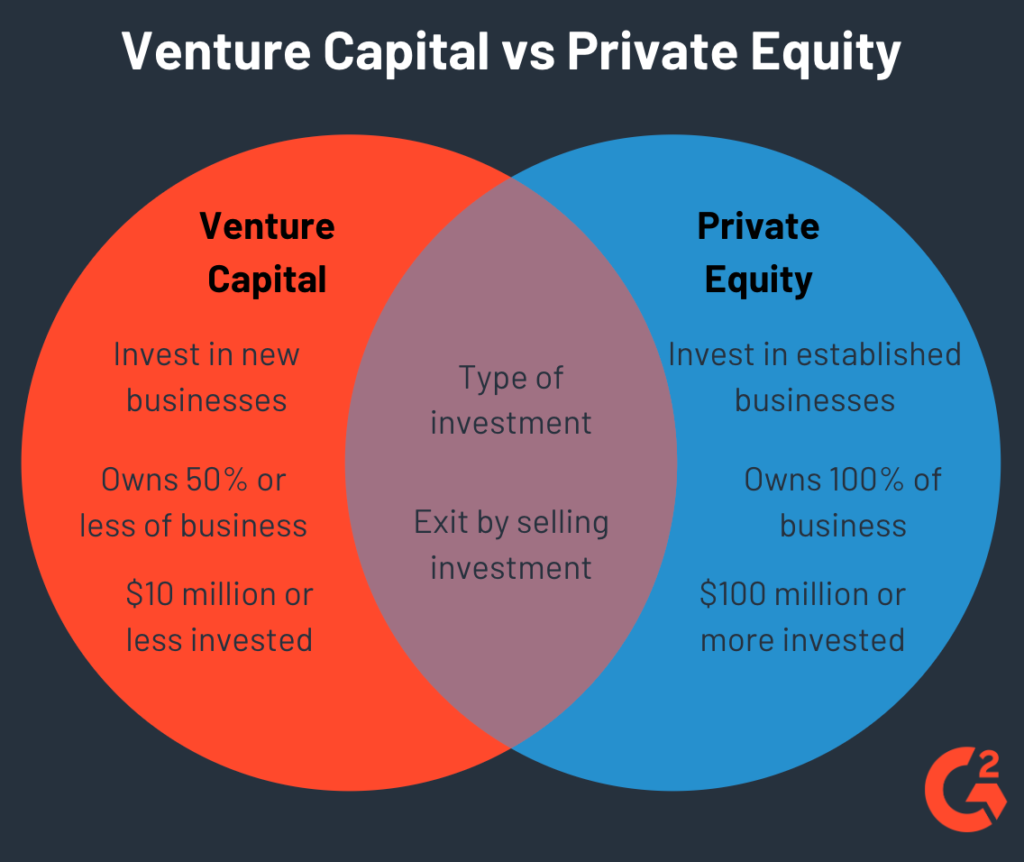

Startups and early-stage companies with significant room for development are given the financial boost they need by venture capital (VC), a dynamic type of private equity funding. It entails venture capitalists, or investors, offering funds in return for equity stakes in these businesses. VC capital is essential for fostering innovation, empowering business owners to realize their visions, and promoting economic growth. This relationship also provides knowledge, guidance, and connections to the industry, all of which help a business succeed.

Table of Contents

- VC Full-Form: Introduction to Venture Capital

- VC Full-Form The Role of Venture Capital in Startup Ecosystems

- VC Full-Form: Key Players in the Venture Capital Landscape

- VC Full Form: Venture Capital and Innovation

- VC Full Form: Key Stages in the Venture Capital Investment Process

- VC Full-Form: How Venture Capital Works: From Pitch to Funding

- VC Full Form: Challenges in Venture Capital

- VC Full-Form: Different Stages of Venture Capital Investment

- VC Full-Form: Risks and Rewards of Venture Capital Investing

- VC Full-Form: Trends and Innovations in Venture Capital Funding

- VC Full-Form: Impact of Venture Capital on Innovation and Economic Growth

- VC Full-Form: Building Successful Partnerships between Entrepreneurs and VCs

- VC Full-Form: Frequently Asked Questions(FAQs)

VC Full-Form: Introduction to Venture Capital

Startups and early-stage companies with significant room for development are given the financial boost they need by venture capital (VC), a dynamic type of private equity funding. It entails venture capitalists, or investors, offering funds in return for equity stakes in these businesses. VC capital is essential for fostering innovation, empowering business owners to realize their visions, and promoting economic growth. This relationship also provides knowledge, guidance, and connections to the industry, all of which help a business succeed. Venture capital is an essential part of the entrepreneurial ecosystem because it enables the creation of ground-breaking innovations, game-changing business models, and revolutionary goods that reshape markets and economies.

VC Full-Form: The Role of Venture Capital in Startup Ecosystems

Venture capital (VC) holds a vital role within startup ecosystems by infusing financial resources, expertise, and strategic guidance into early-stage companies. This form of investment empowers entrepreneurs to transform innovative ideas into viable businesses. VC firms assess and select startups with significant growth potential, providing them with essential funding to scale operations, develop products, and enter the market. Beyond financing, venture capitalists offer mentorship, networking opportunities, and industry insights, propelling startups toward success. By nurturing these fledgling enterprises, venture capital fuels innovation, creates jobs, and fosters economic dynamism, shaping the entrepreneurial landscape and contributing to societal progress.

VC Full-Form: Key Players in the Venture Capital Landscape

The venture capital landscape comprises several key players that collaborate to drive startup growth and innovation. At its core are venture capitalists (VCs), who provide funding and expertise to startups in exchange for equity. Startups seeking investment are central to this dynamic, as they present innovative ideas and growth potential. Angel investors often act as initial backers, providing seed funding. Additionally, incubators and accelerators nurture startups through mentorship and resources. Corporations are increasingly involved, establishing corporate venture arms to tap into emerging technologies. Together, these players create a vibrant ecosystem that nurtures entrepreneurship, accelerates business development, and fosters technological advancement.

VC Full Form: Venture Capital and Innovation

1. What is Venture Capital (VC)?

Venture Capital refers to investment furnished with the aid of using traders to startups and early-level organizations with excessive increase potential. It is a lifeline for progressive corporations desiring monetary help to scale.

2. The Importance of Innovation in VC

Innovation is on the center of VC investments. Venture capitalists are seeking for groundbreaking thoughts which could disrupt markets and create good sized value.

3. How Venture Capital Drives Economic Growth

VC investment helps task creation, new technologies, and enterprise transformation, contributing to the wider financial improvement of areas and nations.

4. The Role of Venture Capitalists

Venture capitalists aren’t simply funders; they act as mentors and advisors, supplying strategic insights and enterprise connections to assist startups thrive.

5. Stages of Venture Capital Investment

From seed investment to Series A, B, and beyond, VC investments help corporations at numerous increase phases, making sure they attain their complete potential.

6. Equity Stakes and Business Ownership

In go back for investment, task capitalists take fairness stakes, sharing withinside the hazard and rewards of a business`s fulfillment or failure.

7. Challenges Faced with the aid of using VC-Backed Startups

Startups need to meet excessive expectancies for increase and innovation, navigate marketplace risks, and manipulate investor relationships effectively.

8. The Future of Venture Capital and Innovation

As era evolves, VC will retain to pressure innovation, specializing in regions like AI, smooth energy, and biotechnology to form tomorrow’s industries.

VC Full Form: Key Stages in the Venture Capital Investment Process

1. Deal Sourcing

This is the preliminary degree in which task capitalists (VCs) become aware of capacity funding possibilities. They frequently rely upon networking, enterprise events, and referrals from relied on reassets to find out startups with excessive increase capacity.

2. Due Diligence

After a capacity deal is identified, VCs behavior thorough due diligence to assess the commercial enterprise`s financials, marketplace capacity, product viability, and the startup’s control team. This facilitates examine hazard and the probability of success.

3. Term Sheet Negotiation

Once due diligence is complete, VCs and the startup negotiate the phrases of the funding. This report outlines the funding amount, fairness stake, valuation, and different key situations for the partnership.

4. Investment Decision

In this degree, the task capital organization makes a very last choice on whether or not to continue with the funding. The VC evaluates the startup`s long-time period increase capacity and the fee they could deliver past simply investment.

5. Post-Investment Monitoring

After investing, VCs intently reveal the startup’s progress. They tune economic performance, provide strategic advice, and can assist construct commercial enterprise connections to make certain the startup grows successfully.

6. Scaling and Growth Support

VCs frequently offer now no longer simply investment however additionally steering in scaling the commercial enterprise. This consists of supporting with hiring key personnel, increasing marketplace reach, and refining commercial enterprise operations to put together for fast increase.

7. Exit Strategy Development

VCs generally search for go out possibilities to recognise a go back on their funding. This might be thru an acquisition, merger, or preliminary public offering (IPO) that permits them to coins out their fairness.

8. Exit Execution

The very last degree happens whilst the startup achieves a a hit go out. VCs acquire a part of the proceeds primarily based totally on their fairness stake, and the startup profits get right of entry to to extra assets for destiny increase.

VC Full-Form: How Venture Capital Works: From Pitch to Funding

Venture capital operates through a multi-step process, starting with entrepreneurs pitching their business ideas to venture capitalists. After a rigorous evaluation involving market analysis, technology assessment, and team scrutiny, the VC firm decides whether to invest. If selected, negotiations on terms and equity distribution occur, culminating in a signed term sheet. Due diligence follows, where the startup’s finances, operations, and legal aspects are thoroughly examined. Once cleared, the final funding agreement is executed, and the VC firm becomes a partner, providing funding, guidance, and support to foster the startup’s growth.

VC Full Form: Challenges in Venture Capital

1. High Risk of Investment

Venture capital investments are inherently risky, with many startups failing to attain profitability or scale. Investors need to cautiously check capability rewards towards good sized risks.

2. Difficulty in Valuation

Valuing early-level businesses may be difficult because of constrained monetary records and unsure destiny earnings. Accurate valuation is crucial for each buyers and entrepreneurs.

3. Market Competition

Startups face excessive opposition now no longer handiest from different agencies however additionally from set up businesses with extra resources. VC-sponsored businesses need to innovate to live ahead.

4. Finding the Right Investment Opportunities

Venture capitalists need to sift via severa possibilities to pick out the maximum promising ones. This method calls for deep marketplace understanding and instinct to identify high-increase capability.

5. Pressure for Rapid Growth

VC-sponsored businesses are frequently beneathneath strain to scale quickly, that could cause operational strain, compromising long-time period sustainability for short-time period increase.

6. Managing Investor Expectations

Maintaining a stability among investor needs and the company`s imaginative and prescient may be difficult. Venture capitalists count on robust returns, that could every now and then struggle with the entrepreneur`s goals.

7. Exit Strategy Challenges

Exiting an funding via acquisition or public providing may be unsure and time-consuming. Timing the go out flawlessly is vital for maximizing returns.

8. Market Uncertainty and Economic Conditions

External elements consisting of financial downturns, adjustments in customer behavior, and technological disruptions can appreciably have an effect on the achievement of VC-sponsored startups, growing an unpredictable funding landscape.

VC Full-Form: Different Stages of Venture Capital Investment

- Seed Stage: Early funding for idea validation and product development.

- Early Stage (Series A and B): Funding for refining products, building customer base, and expanding.

- Growth Stage (Series C and beyond): Scaling operations, entering new markets, and accelerating growth.

- Bridge Financing: Short-term funding to bridge gaps between larger investment rounds.

- Mezzanine Financing: Preparing for IPO or acquisition, with larger sums at stake.

- Exit Stage: Venture capitalists exit by selling their equity through IPOs or acquisitions, reaping returns on their investments.

VC Full-Form: Risks and Rewards of Venture Capital Investing

- High Returns: Successful startups can yield substantial returns, outperforming traditional investments.

- Early Access: Investors tap into innovative technologies and disruptive ideas before they reach the broader market.

- Portfolio Diversification: VC investments diversify investment portfolios, potentially reducing overall risk.

- Networking Opportunities: Investors gain access to a network of entrepreneurs, experts, and fellow investors.

Risks:

- High Failure Rate: Many startups fail, leading to potential losses for investors.

- Illiquidity: VC investments can be tied up for years, limiting access to funds.

- Market Volatility: Startup valuations can fluctuate significantly due to market shifts.

- Lack of Control: Investors have limited control over startup management decisions.

- Long Timeframes: It may take years for investments to yield returns, requiring patience.

VC Full-Form: Trends and Innovations in Venture Capital Funding

Diverse Investment Models: New models like revenue-based financing and venture debt offer alternative funding options.

Remote Investing: Virtual communication enables investors to engage with startups globally, expanding investment opportunities.

Impact Investing: Investors focus on startups with positive social and environmental impacts.

AI and Data Analysis: Advanced analytics help VCs identify trends, predict success, and make data-driven investment decisions.

Crypto and Blockchain: Digital assets and blockchain technology are reshaping fundraising and ownership structures.

Corporate Venture Capital: Corporations establish venture arms to invest in and collaborate with startups for mutual benefits.

Secondary Markets: Investors trade existing shares of private startups, creating liquidity opportunities.

VC Full-Form: Impact of Venture Capital on Innovation and Economic Growth

- Innovation Catalyst: VC funding injects resources into innovative startups, enabling them to develop new technologies, products, and services.

- Risk Capital: VCs take on higher risks, allowing entrepreneurs to experiment and pursue breakthrough ideas that traditional financing might shy away from.

- Job Creation: Successful startups funded by VCs create jobs, contributing to local economies and employment opportunities.

- Knowledge Transfer: VCs provide mentorship, guidance, and industry connections, transferring expertise from experienced investors to startups.

- Market Competition: VC-backed startups disrupt established industries, promoting healthy competition and driving improvements.

- Ecosystem Growth: A thriving VC ecosystem attracts talent, investors, and entrepreneurs, fostering innovation hubs that spur economic development.

VC Full-Form: Building Successful Partnerships between Entrepreneurs and VCs

- Shared Vision: Entrepreneurs and VCs should share a clear vision for the startup’s growth trajectory and goals.

- Mutual Trust: Building trust fosters open dialogue and collaboration, vital for making joint decisions.

- Transparency: Openly sharing challenges, progress, and financials helps maintain transparency and manage expectations.

- Clear Roles: Define roles and responsibilities to ensure each party understands their contribution and involvement.

- Effective Communication: Regular updates and feedback loops help prevent misunderstandings and build rapport.

- Long-Term Perspective: Both sides should focus on the long-term success of the business rather than short-term gains.

- Flexibility: Adaptability is key as business landscapes change; adjusting strategies together ensures resilience.

- Leverage Expertise: VCs offer industry insights and connections, while entrepreneurs contribute domain expertise.

- Alignment of Interests: Agree on milestones, exit strategies, and equity distribution to ensure aligned interests.

- Exit Planning: Discuss potential exit scenarios early to avoid conflicts and plan for a harmonious exit.

VC Full-Form: Frequently Asked Questions(FAQs)

Venture capital is a form of financing provided by investors (venture capitalists) to startups and early-stage companies with high growth potential in exchange for equity ownership.

Venture capitalists invest in startups at various stages of development, providing funding, expertise, and resources to help them grow and succeed. They typically exit their investments through IPOs, acquisitions, or secondary markets.

VCs invest across different stages, including seed (early idea stage), Series A (early growth), Series B and C (expansion), and sometimes even later-stage growth or pre-IPO.

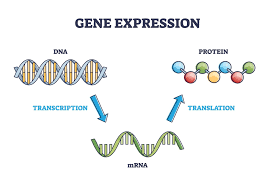

Mutations or dysregulation of UTRs can disrupt gene expression, leading to diseases. Altered UTR functions can result in abnormal protein levels, affecting cellular processes and contributing to disorders.

VCs seek startups with innovative ideas, strong market potential, a capable team, a clear business model, and a competitive advantage.

Startups can approach VCs through warm introductions, networking events, pitch competitions, accelerator programs, and online platforms. A solid pitch and a well-prepared business plan are essential.

A term sheet is a non-binding agreement outlining the terms and conditions of an investment. It serves as a basis for negotiations between the startup and the investor.

Yes, UTRs can contain exonic splicing enhancers or silencers that impact alternative splicing, leading to the production of different protein isoforms from the same gene.

Startups often require VC funding to scale their operations, develop products, expand marketing efforts, and hire talent. VC provides the financial boost needed for rapid growth.

- Angel investors are usually individual investors who provide early-stage funding in exchange for equity.

- Venture capitalists are typically part of a firm that invests in later-stage, higher-value startups and often provide larger funding amounts.